In a world grappling with a pervasive loneliness epidemic, the desire for belonging is universal. Individuals seek to feel deeply connected to their homes and aspire to homeownership. They are also actively looking for innovative approaches to earn and pay their rent.

The multifamily real estate and PropTech sectors are undergoing unprecedented growth. The global PropTech market is valued at $35–$40B in 2025. It’s projected to more than double by 2030–2034, reaching $100B–$179B.

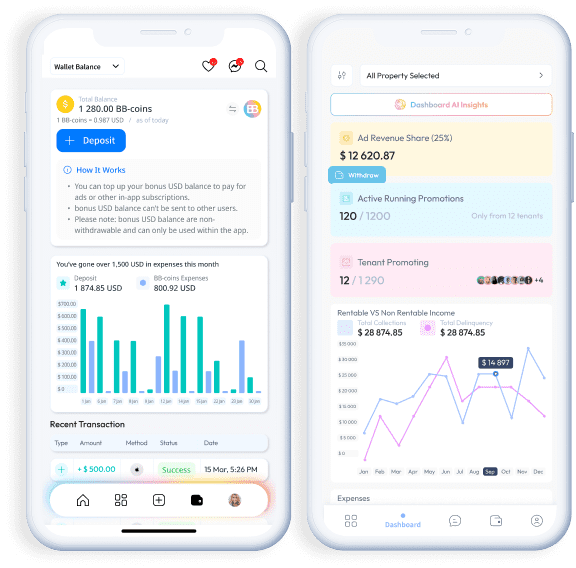

Be Belong is at the forefront of this movement: bringing AI-powered community engagement, property operating systems, and blockchain-enabled ownership into one seamless ecosystem. This is where belonging meets innovation, creating lasting value for residents and owners alike.

Join the leaders shaping the next trillion-dollar industry.

Our mission is to solve the global challenge of belonging by turning apartment buildings into connected, thriving communities.

Through purpose-driven community engagement that deepens connections, a smart Property Operating System that simplifies life for residents and managers, and RentGain, a rewards-driven model that makes paying rent easier, we create a powerful ecosystem.

The result: stronger communities, loyal residents, and increased income for owners and managers.

Be Belong has strong potential for a profitable future because the multifamily market offers endless opportunities for growth. With increasing demand for resident engagement and digital community solutions, there’s significant room to expand, innovate, and create long-term value.

We integrate AI-driven property management, blockchain-enabled ownership models, and community engagement tools to streamline operations and support long-term tenant satisfaction. These innovations are intended to enhance our real estate investment approach.

As with all real estate, market conditions, tenant occupancy, and operational challenges may affect performance. While we incorporate multiple technologies and management strategies, these do not eliminate the inherent risks associated with real estate investing

I’d be happy to discuss specific partnership options in our follow-up conversation. We have various entry points designed to accommodate different partners’ profiles while maintaining our commitment to quality and impact.

We integrate technology and data-driven efficiencies to optimize NOI, reduce operational costs, and enhance asset performance. Additionally, our platform provides a pathway to fractional ownership, unlocking liquidity options that traditional models lack.

Our team combines institutional expertise from leading banks, Fortune 500 firms, and tech innovators. We actively manage assets to optimize performance and apply proven financial strategies to maximize returns while preserving capital.

We partner with RIAs, family offices, and high-net-worth individuals seeking stable cash flow, strong upside potential, and lower-risk exposure in multi-family real estate. Our model particularly attracts those seeking an alternative to traditional private equity real estate funds.